How to Start Forex Trading: A Comprehensive Guide

Forex trading, or currency trading, is the act of buying and selling currencies in the foreign exchange market. This market is one of the largest and most liquid financial markets in the world. For those who are new to trading, starting in Forex can seem daunting, but with the right guidance, it can be a rewarding endeavor. This article will guide you through the essential steps to start your Forex trading journey, including how to choose brokers, develop trading strategies, and manage risks effectively. To begin, you may want to consider a reputable trading platform, such as those found in how to start forex trading Forex Brokers in Argentina.

Understanding the Forex Market

The Forex market operates 24 hours a day, five days a week, providing traders with the flexibility to trade at any time that suits them. The market does not operate centrally; rather, it consists of a network of banks, financial institutions, corporations, and individual traders who buy and sell currencies. Knowing how the Forex market works, including terms like “pips,” “leverage,” and “spreads,” is fundamental before beginning your trading journey.

Step 1: Educate Yourself

Before you start trading, it is crucial to educate yourself about the Forex market. There are various online resources, courses, and books available for beginners. Understanding key concepts such as technical analysis, fundamental analysis, and trading psychology can prepare you for the challenges ahead. Practical knowledge about market behavior and currency pairs will also significantly improve your trading skills.

Step 2: Choose a Reliable Forex Broker

One of the first steps in starting Forex trading is selecting a reputable broker. A broker acts as an intermediary between you and the market. Factors to consider when choosing a broker include regulatory compliance, trading fees, available currency pairs, and customer service. Ensure that the broker you select offers a trading platform that meets your specific needs and is user-friendly.

Step 3: Open a Trading Account

Once you have selected a broker, the next step is to open a trading account. Most brokers offer various account types, including demo accounts for practice and live accounts for real trading. A demo account allows you to familiarize yourself with the trading platform without risking real money. Take advantage of this opportunity to practice trading and test your strategies.

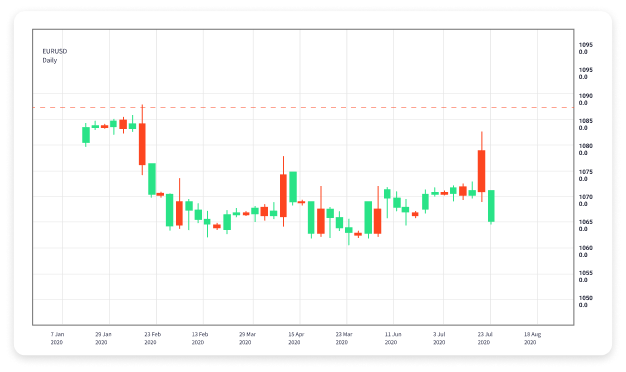

Step 4: Learn to Analyze the Market

Effective trading requires a solid understanding of market analysis. There are two primary forms of analysis: technical analysis and fundamental analysis. Technical analysis involves analyzing price charts and patterns to predict future price movements. Fundamental analysis focuses on economic indicators, news events, and geopolitical factors that can affect currency values. Combining both analysis methods can give you a comprehensive perspective of the market.

Step 5: Develop a Trading Strategy

Having a clear trading strategy is crucial for success. A trading strategy outlines your approach to entering and exiting trades, including criteria for risk management. Determine your trading style—whether day trading, swing trading, or scalping—and develop a plan that suits your personality and lifestyle. Backtesting your strategy on historical data can help you refine it before risking real capital.

Step 6: Manage Your Risks

Risk management is a critical component of successful Forex trading. Understand how much capital you are willing to risk on each trade and use tools such as stop-loss orders to minimize potential losses. A common rule among traders is to risk no more than 1% to 2% of your trading capital on any single trade. Additionally, diversifying your trades and avoiding over-leveraging can help protect your account from significant drawdowns.

Step 7: Start Trading

After you have educated yourself, chosen a broker, and developed a strategy, you are ready to start trading. Begin with small amounts while you gain experience and confidence. Monitor your trades closely and learn from your mistakes. Keeping a trading journal can help you track your performance, analyze your decisions, and continually improve your strategy.

Step 8: Stay Informed

The Forex market is influenced by numerous factors, including economic reports, interest rates, and geopolitical events. Staying informed about these factors can help you make better trading decisions. Regularly read market news, follow economic calendars, and participate in trading communities to enhance your understanding of market dynamics.

Conclusion

Starting Forex trading requires knowledge, patience, and discipline. By following the steps outlined in this guide, you can establish a strong foundation for your trading journey. Remember that success in Forex trading doesn’t come overnight; it demands consistent practice and a willingness to learn from both successes and failures. With dedication and the right approach, you can navigate the challenges of the Forex market and achieve your trading goals.