Blogs

Diane Campbell, 68, lives in Virginia and you may primarily hinges on the girl Social Shelter earnings to pay for basics. She told you of a lot older adults for example her are anxious from the Personal Defense funding — and wish to see a more tangible plan in the authorities from the protecting the application to have coming many years. It’s your playground – mention, try, and have the new video game you to resonate as well as your design. Establishing the gambling enterprise registration is simply a portal to everyone out of Bitcoin to play. From the honing in addition to education, someone is going to be instead boost their probability of effective and you will intensify all round web based poker end up being.

Just how can your discounts compare with the common Aussie? six simple information

His advice for almost every other millennials wanting to break right into Australia’s homes marketplace is to target to buy something they are able to afford today, instead of something they require money for hard times. “Using up home financing back in the newest 90s did not become including a lifetime phrase, whereas now individuals are saddling themselves with the far financial obligation, it feels near impossible to pay off the loan easily,” Ms Tindall states. To have millennials borrowing inside mid-2022, around a few-thirds of one’s 1st fees try focus — even though he says the interest show have and certainly will continue ascending as the rates go up and cost slip. But not, the bigger assets prices faced from the newest consumers mean the dominating repayments might possibly be large, give their full financing payments closer to the brand new highs of the mid-eighties and you will early 90s.

How to calculate online worth

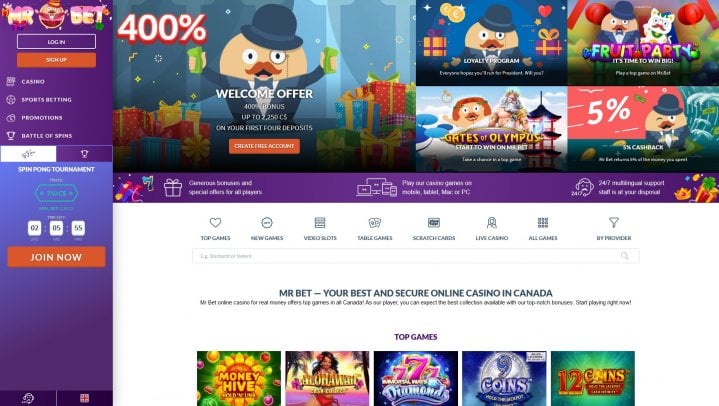

Perhaps the new argument is that running bucks had a payment also. Anytime you to definitely costs is going to be invisible on the goods price, as to why https://happy-gambler.com/tobwin-casino/ can also be’t many of these nickel and dinner costs end up being absorbed as well? To anyone merchant I guess in a sense, he could be incentivising cash, which is against the constant development. I am willing to play with a credit, but some eating and cafes provides a good surcharge to possess credit have fun with.They’ve set their rates up and delivered a credit surcharge.

All of our Information Circle

There are several extra has right here and you should utilize them to compliment the financial circulate. Government tax policy is additionally a factor, that have significant imposts wear to buy, for example hefty stamp obligations charge, to make houses more costly. They’ve been government incentives, for example homebuyer offers and you may concessions, which are adopted to switch cost but often perform the direct reverse by inflating demand and you will cost. When you’re men and women have transferred to regional components inside the pandemic, governments usually retreat’t done a fantastic job thus far of creating yes these parts have sufficient also have or system. “One thing got away from whack on the 2000s once we massively improved the new immigration intake but didn’t increase the supply of property to fit.”

A proper answer is just to give your a $5 mention and leave without worrying from the other things. Today Really don’t care if cash stays or happens, but of a resillience point of view dollars nonetheless sounds digital and in case I just return thirty days (hello Optus Outage, Good morning CBA EFT critical outage). The costs, winnings to the several organizations inside must be protected. For the organization dealing with a large amount of bucks it involves loads of rates. The brand new reasoning you to a reduction from 27 per cent to 13 per cent from purchases within the last 3 years meaning that in certain a lot more years we are cashless is actually deeply flawed.

Liabilities are the thing that you borrowed from, like your home loan, people money you possess and your an excellent expenses. Their bank card balance are an accountability as this is currency you borrowed. Plunge deeper on the possessions belonging to baby boomers and millennials, the analysis means that truth be told there’s an improvement from the value of the fresh possessions possessed. Even though millennials only features 13.2% of the country’s overall wide range in accordance with home, that’s where a majority of their currency (42.2%) are held. “Whilst it’s unequivocally correct that lower rates have raised home cost and made they harder for earliest-home buyers, it’s maybe not the newest RBA’s role and then make property sensible,” Mr Moore said.

Middle-agers must improve the young members of their family get for the needs. Don’t exit cash on the brand new dining table — it only takes times to utilize and it obtained’t feeling your credit score. Away from pills which can be meant to target age you can be anybody else to features low energy, medications is actually a good multi-billion business in the us, so there’s no indication of one changing any time soon. An informed a couple dollars we can offer should be to hop out social networking, and you may wear’t buy to the generational arguments. For individuals who wear’t accept a housing policy, vote consequently otherwise produce for the regional Member or Minister. When the both dad and mom are on full-day wages, the possibilities of spending money on child care increases, too.

Whether or not Really don’t alive here more, it’s still an area I repeated tend to (my father life truth be told there). It’s only 1 urban area I understand, however, I didn’t discover a single bucks notice transform give. Possibly the regional growers were tapping its cell phones thereon EFTPOS server in the pub.

It appears you to also one particular who’ve taken the time in order to draft a can, they aren’t so it is clear to their survivors the spot where the tend to try or what exactly is in it. For the majority of household, an easy recipient deed, and this transmits the fresh term abreast of dying, will do the secret. Chelsea Atkinson knew, at the least in principle, one to the woman father’s house might someday be hers. These types of efficiency reveal that many people are protecting to have a rainy go out, something money benefits strongly recommend is a good behavior to cultivate. The fresh Federal Put aside, the fresh central financial of your own All of us, gets the country having a secure, flexible, and you may secure monetary and you will financial system. A similar info the newest realize when you’re probability of profitable boy bloomers place is comparable having compared to withdrawing.